Sheng Ye Information Technology Service (Shenzhen) Co., Ltd. (“SYIT”), a wholly owned subsidiary of Sheng Ye Capital Limited (“SY Capital”, HKEx: 6069), and Guangzhou Tungee Technology Co., Ltd. (“Tungee”), a leading SaaS solution provider for sales intelligence in China, today announced that they have signed a cooperation agreement to develop big data capabilities based on publicly available data. The partnership will leverage Tungee’s data analytic and algorithm strengths and SYIT’s smart supply chain management and digital fintech capabilities to gather data from multiple sources, develop robust risk models, and create a multi-dimensional platform that will help SY Capital monitor and analyze thousands of data points across the sectors it serves.

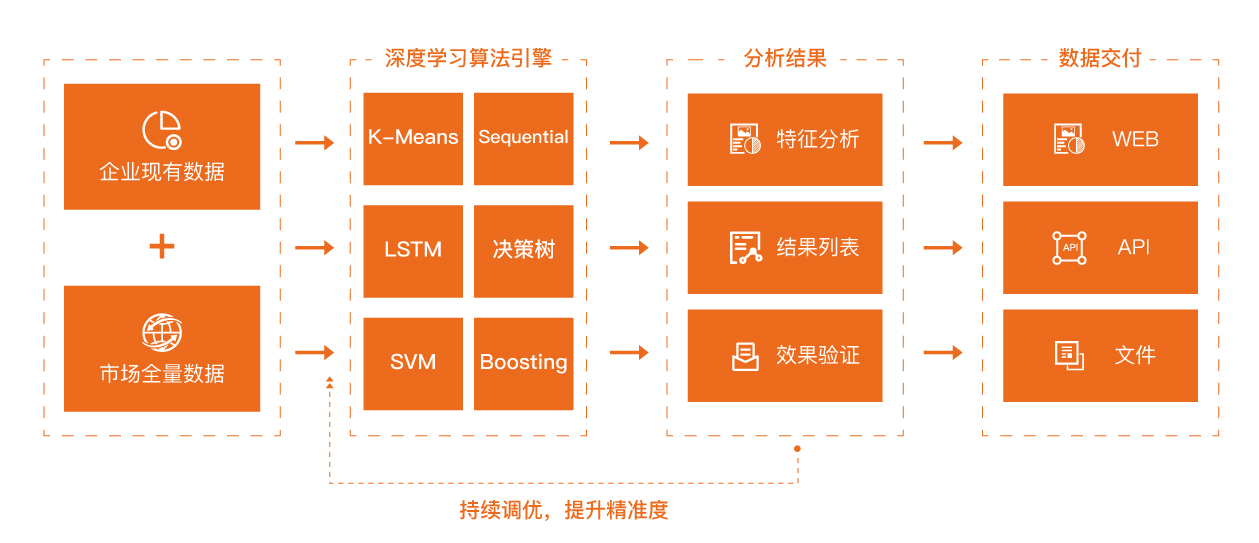

As a national high-tech enterprise, SYIT has been widely recognized in the industry and among key industry players for its strong industrial internet of things (“IoT”) and supply chain financial technologies. Based on a “big data + public opinion intelligence” cooperation model, SYIT and Tungee will join forces to develop algorithms that generate propensity scores for SY Capital’s core enterprise customers. By monitoring and analyzing public information, the platform will help make inferences and determine whether sentiment is positive or negative. The results will be applied to SYIT’s risk management system, especially for pre-loan assessments and real-time post-loan risk monitoring and early warning processes.

Tungee has significant technical processing expertise in data intelligence, and is able to conduct propensity analyses with over 95% accuracy. The two companies will combine Tungee’s data intelligence technology and SYIT’s fintech leadership to help SY Capital effectively improve the timeliness and expand the coverage of public data monitoring, and augment its data analysis and risk control capabilities. Currently, SY Capital has integrated into the supply chain ecosystems of 11 core enterprises, achieved total cumulative assets under management of more than RMB100 billion, and provided flexible supply chain financing solutions to more than 8,200 small, medium, and micro enterprises (“SME”).

Founded in 2016 and headquartered in Guangzhou, Tungee is a leading sales intelligence SaaS company in China and is committed to helping enterprises improve their sales efficiency and performance with big data and AI technology. It provides comprehensive sales intelligence solutions to B2B enterprises, with services ranging from lead mining, business opportunity engagement, and customer relationship management to order analysis. Tungee has served over 10,000 clients – including tech giants Alibaba, Inspur and Focus Media – across over 20 sectors. Since its inception, Tungee has received funding support from top-tier investors, including Alibaba, Sequoia Capital, Qiming Venture Partners and Unity Ventures.

Going forward, SYIT will continue to implement its “Dual Engine” strategy by enhancing its industrial technology and digital financing capabilities, iterate its big data-powered risk control technology, improve risk management, proactively promote supply chain innovation and development, and provide more flexible supply chain financing services to a growing number of SME customers.